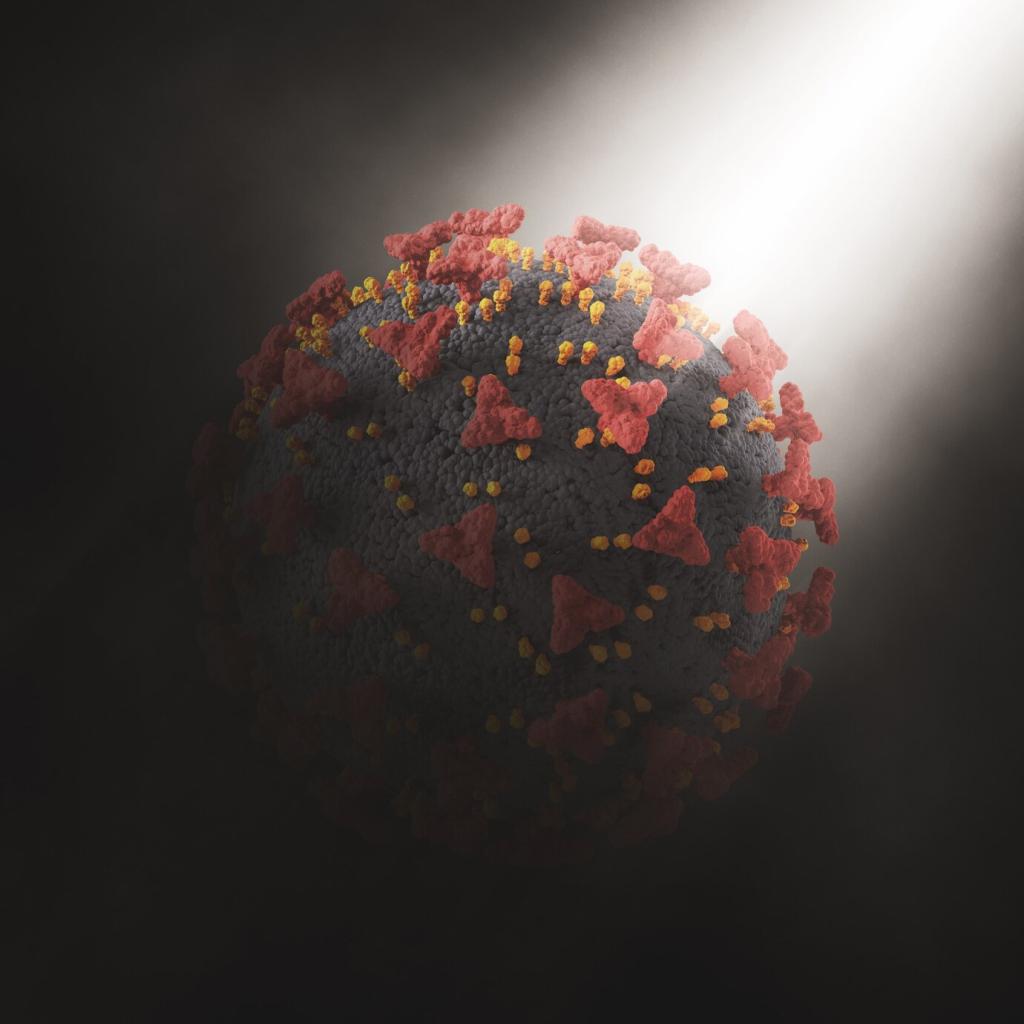

Chosen theme: Financial Markets Reaction to Global Health Crises. Explore how outbreaks ignite volatility, rotate sector leadership, and reshape investor behavior. Discover stories, data, and practical strategies to navigate uncertainty. Join the discussion and subscribe for thoughtful, timely updates.

From Headlines to Price Action: Understanding the Shockwave

The first 72 hours: signals, liquidity, and reflexes

Outbreak headlines spread faster than valuation models can adjust, triggering a scramble for liquidity. On Italy’s 2020 lockdown news, futures gapped, the VIX leapt, and market makers widened spreads as algorithms chased momentum. Tell us: where were you when volatility spiked?

Liquidity crunch versus solvency fear

In the earliest phase, funding stress dominates as investors rush to cash, pressuring commercial paper and credit ETFs. Soon after, solvency fears surface, widening high-yield spreads. Share your framework for distinguishing temporary liquidity squeezes from deeper, balance-sheet risk.

Selloff, stabilization, and the policy-fueled rebound

Typical crisis arcs move from capitulation to cautious stabilization and policy-supported rebounds. Markets sniff out turning points before headlines confirm them. Did you rebalance into strength, or wait for clarity? Comment with what told you the panic was exhausting.

E-commerce, cloud software, digital payments, and telemedicine thrived as daily life moved online. By mid-2020, technology benchmarks reclaimed highs, reflecting durable adoption curves. Which digital trends from lockdowns still shape your portfolio today? Share your long-run conviction picks.

Policy Firehoses: Liquidity, Backstops, and Signals

Central banks as first responders

Emergency rate cuts, expanded asset purchases, and dollar swap lines restored critical plumbing in March 2020. Facilities supporting corporates and money markets calmed funding fears. Which central bank moves most changed your risk appetite? Share the announcement that turned your screen green.

Fiscal bridges over economic shutdowns

Stimulus checks, wage subsidies, and loan guarantees aimed to preserve incomes and business continuity. Markets priced both the immediate cushion and future growth paths. Did fiscal policy alter your cash flow estimates? Tell us how you modeled policy longevity and targeting.

Communication and credibility as catalysts

Clear forward guidance compresses uncertainty, sometimes more effectively than balance-sheet expansion alone. Credible commitments can crowd investors back into risk. Which press conference or statement changed your positioning? Comment with the messaging cues you monitor during turbulence.

Behavioral Finance Under Quarantine

The VIX spiked above 80 in March 2020, reflecting extreme uncertainty and forced de-risking. Herding amplifies moves as stop-losses trigger. How do you prevent volatility from hijacking your plan? Share your rules for staying rational when screens flash red.

Behavioral Finance Under Quarantine

Story stocks surged as attention concentrated on remote work, home fitness, and collaboration. Some narratives endured; others fizzled with normalization. Which signals help you separate durable adoption from hype? Tell us how you track the life cycle of viral themes.

Behavioral Finance Under Quarantine

Predefined rebalancing bands, checklists, and journaling create guardrails when emotions spike. Many readers report reviewing theses weekly and sizing positions conservatively. What ritual kept you grounded? Share your process so others can build sturdier playbooks for future shocks.

SARS 2003: short, sharp, and regional

SARS hit travel and retail in Asia, but containment and reopening spurred relatively swift recoveries. Markets punished proximity and rewarded resilience. Which historical analogs inform your playbook today? Share the data you revisit when headlines turn alarming.

Ebola and Zika: localized stress, global vigilance

While primarily regional in economic impact, these outbreaks reminded investors how quickly precautionary behavior dents demand. Biotech occasionally rallied on research pipelines. Do you track regional indices for early read-throughs? Tell us how you map contagion to market exposure.

COVID-19: unprecedented speed and scale

Markets entered a bear phase in record time, then rebound momentum carried major indices to new highs within months. Policy scale and digital acceleration shaped leadership. What timeline surprised you most? Comment with the pivot point that changed your outlook.

Quality, balance, and optionality

Favor strong balance sheets, flexible cost structures, and diversified revenue. Blend defensives with growth drivers benefiting from digital adoption. Keep dry powder for dislocations. What mix helped you sleep at night? Share allocations that balanced durability and upside potential.

Hedges and safe havens, costs included

Protective puts, collars, duration exposure, and gold can cushion drawdowns—but premiums and basis risk matter. Define triggers, sizes, and expiries ahead of time. Which hedges proved reliable for you? Comment with tactics that paid off without overwhelming returns.

Your crisis dashboard: signals that matter

Track hospitalizations, mobility, vaccine uptake, policy timelines, PMIs, and earnings guidance for early clues. Tie each metric to specific actions. Want our checklist and templates? Subscribe and tell us which indicators you already rely on during turbulent weeks.